If you want to start a new company, you’re worried that your cash and financing know-how won’t be enough to make it happen? Then go on to learn more about startup financing options in this post because the federal and state governments promote small businesses in a highly focused way, not least because of the benefits to the economy and society.

Do you have a brilliant business idea, or do you like the concept of working for yourself in general? But you’re worried that your cash and founding know-how won’t be enough to make it happen? Then go on to learn more about startup financing options in this post because the federal and state governments promote small businesses in a highly focused way, not least because of the benefits to the economy and society.

Table of Contents

A Brief Recap At A Glance, The Most Important Questions For Startup Financing

Do you wish to learn more about financing for startups? Here are a few of the most typical queries:

What Kind Of Finance Are Accessible To New Businesses?

The startup support administered by various institutions can be cheap loans, guarantees, participation, grants, or subsidized advice. also search Travel Blogger.

Who Is Entitl To Startup Financing?

Many financing programs aimed at a specific target group, e.g., B. to founders from unemployment, innovative projects, or small companies. In principle, no one will exclude – the allocation is usually case-relate.

Is Startup Financing Worth It?

Funded startup consultations are generally well recommended. The benefit must be assessed individually (e.g., the time required for the application vs. chance of success/benefit).

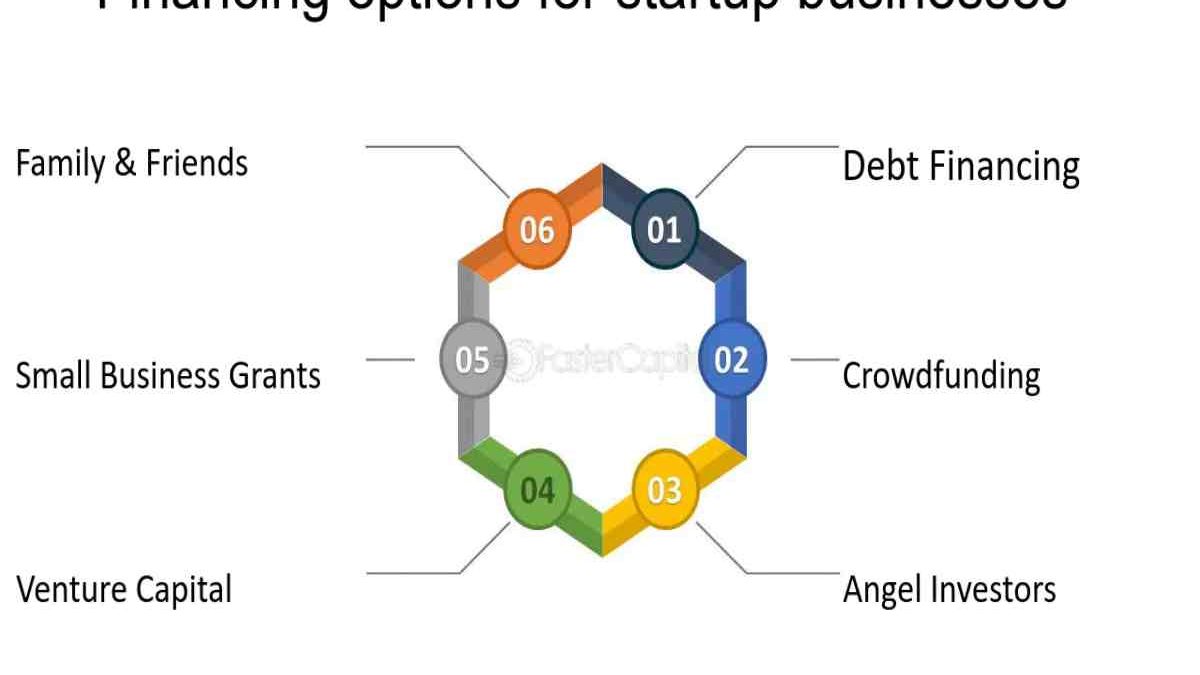

Types Of Financing For Startups

For better orientation in the financing jungle, it makes sense to classify the various offers of startup financing. The following classifications are possible:

Financial Or Intangible

Forms of financial startup support are grants, reduced-rate loans, guarantees, exemptions from liability, and participation. There are also programs with a mix of tangible and intangible benefits. The immaterial offers include inexpensive advice, coaching, knowledge transfer, and network contacts.

Public Or Private Investors

When it comes to startup support, programs from public institutions are usually will meant, mainly including the BMWK, KfW, the development and guarantee banks of the federal states, the employment agency, the job center, and regional public institutions. But there are also private-sector initiatives or cooperations between public and private actors, such as networks at universities.

By Target Group

Some offers differ by the target group. There are also unique financing opportunities for startups that will unemploy.

According TO Region

While the financing programs of the BMWK and KfW are available nationwide, others will limit to certain federal states or regions.

Topic-Specific Distinctions

The offers may differ depending on the topic. It is widespread to get support if you want to have a business plan drawn up, write it using a business plan template, discuss it with a consultant, or have questions about the subject of a financial plan.

The most important financing opportunities will present below, without claiming to be exhaustive.

Five Tips For The Proper Startup Financing

Many offers in this area often seem confusing at first glance. The following tips will assist you in finding your way:

- Research thoroughly which type of financing suits your project. Pay particular attention to the financing conditions so that you do not unnecessarily invest time in application processes with no chance of success. The federal financing database can help you with your search.

- Before applying for subsidized financing, deal with essential topics in this area (e.g., interest, term, creditworthiness, guarantee, exemption from liability).

- Depending on the program, applying for startup financing involves more or less effort. Consider how worthwhile this is. Also, consider the amount of the expect benefit and the likelihood of being accept.

- Your regional Chamber of Industry and Commerce is an excellent first point of contact, where you can get advice on individual it options and support with the application.

Conclusion

Business startups have a variety of positive effects on the economy and society. It applies to micro-enterprises in classic sectors and innovative high-tech startups. Anyone who wants to become an entrepreneur, therefore, has a good chance of benefiting from startup financing, for which there are many contact points and opportunities. Since it is not always easy to keep track of things here, a financing consultation with the regional Chamber of Industry and Commerce is good to start. For startups from unemployment, it is worth looking at the Federal Employment Agency or Jobcentre programs.